The UK’s most and least affordable cities revealed

From rent to wages, our study uncovers the most and least affordable places to live in the country — see where your city ranks.

- London is the most unaffordable city in the UK, with an affordability score of just 3.12/10

- Brighton, 3.5/10, is the least affordable city outside London

- Middlesbrough takes the top spot as the most affordable city, scoring 6.51/10

- Edinburgh has the highest average salary outside London (£47,892 per year on average)

- Brighton has the highest property prices outside London (£420,181 on average), while Aberdeen has the lowest (£134,368)

- Leicester has the lowest average yearly gross disposable household income (GDHI)

- Northern Ireland has the cheapest electricity bills of the regions in the UK

- Southampton has the most expensive petrol prices, while Belfast has the cheapest

- Sunderland has the lowest average council tax in the UK.

From rising inflation rates to soaring rent costs, businesses across the UK are feeling the pinch. But how much does affordability vary depending on where you live?

To find out, we analysed 34 major UK cities across 16 affordability factors — from salaries and house prices to transport and everyday costs — to discover the most and least affordable areas to live.

Our goal? To highlight the differences in affordability across the UK and help businesses understand where costs may be squeezing both their operations and their customers’ spending power.

Jump to a section

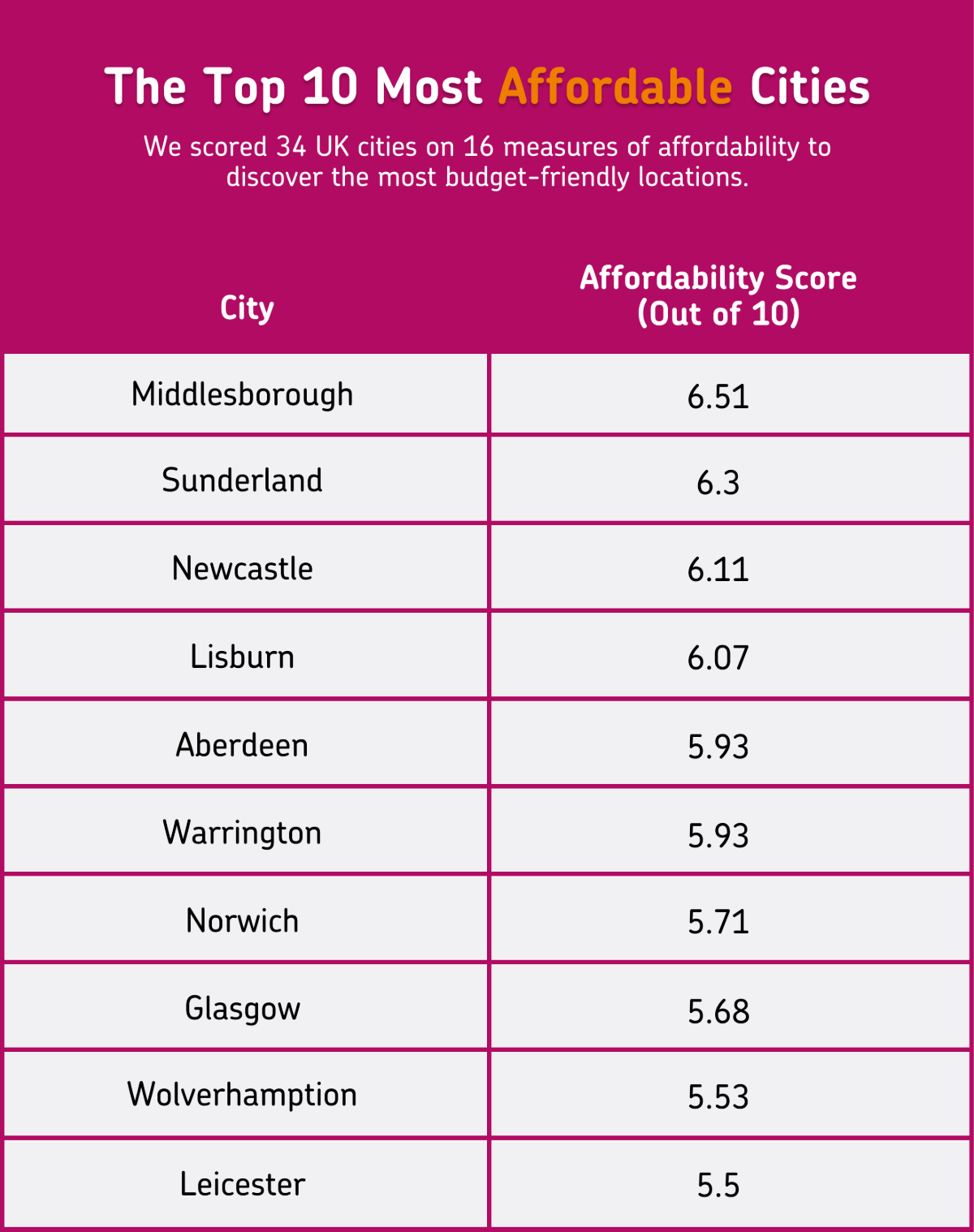

When it comes to reasonable living costs, Middlesbrough takes the top spot for affordability, scoring 6.51/10. It’s closely followed by Sunderland and Newcastle, meaning all three of the UK’s most affordable cities are in the North East — a region long associated with a lower cost of living.

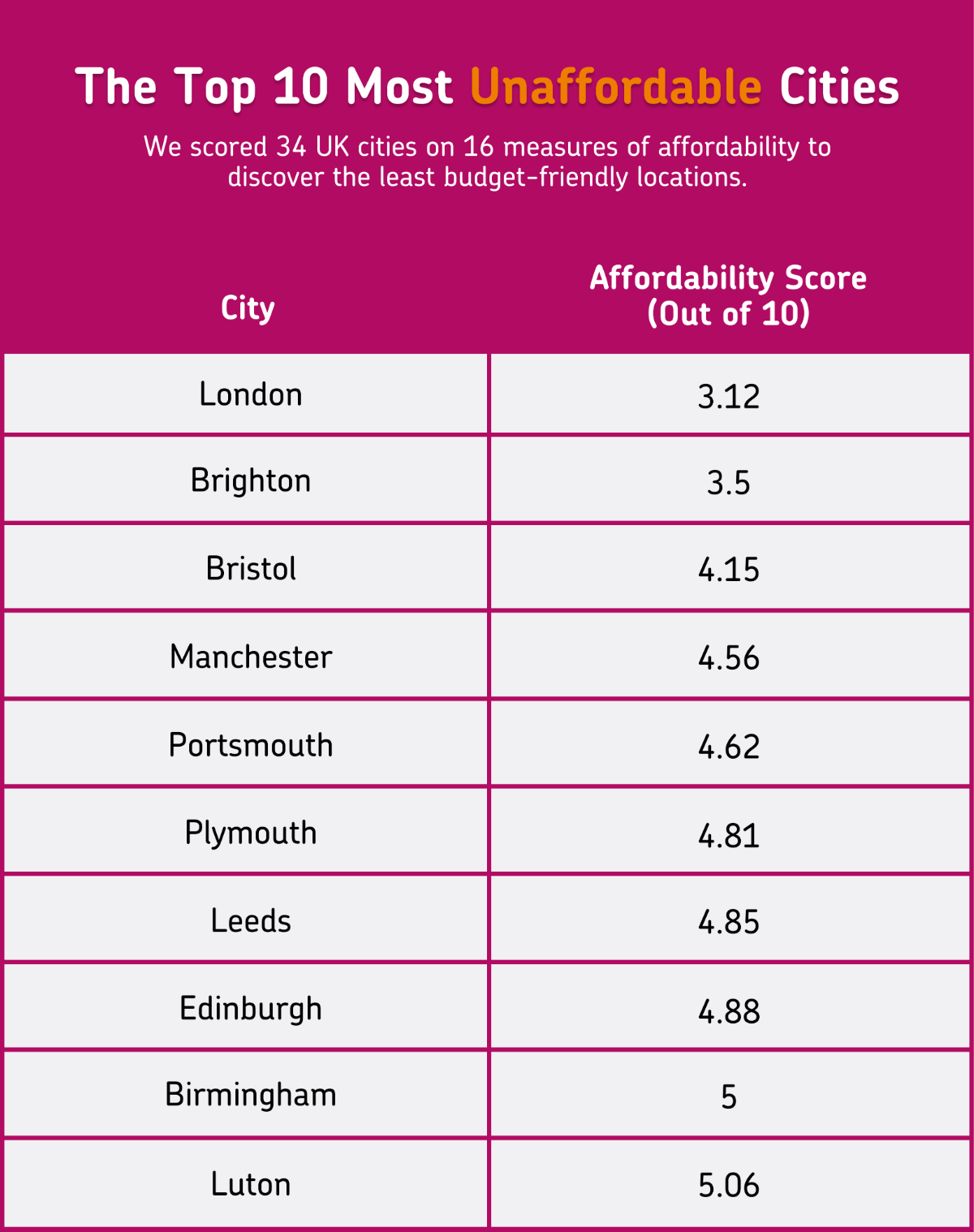

It’s no surprise that London ranks as the least affordable city in the UK, scoring just 3.12/10. Outside of the capital, Brighton and Bristol take the next spots, possibly reinforcing the North-South divide when it comes to living costs.

A closer look at the most affordable cities in the UK

A closer look at the most affordable cities in the UK

| Ranking | City | Average Yearly Salary | Average Property Price | Average Monthly Rent Price | Average Annual Council Tax Bill | Gross Disposable Household Income (GDHI) |

|

Most affordable |

Middlesborough |

36,649 |

139,855 |

609.6 |

1,357 |

17,458 |

|

2nd most affordable |

Sunderland |

36,404 |

141,716 |

623 |

1,149 |

17,458 |

|

3rd most affordable |

Newcastle |

41,944 |

195,095 |

989.3 |

1,252 |

18,136 |

The North East continues to dominate when it comes to affordability, with Middlesbrough, Sunderland, and Newcastle all ranking in the top three most affordable cities.

While these cities benefit from lower property and rental costs, they also have some of the lowest GDHIs in the UK, raising the question: is affordability always a good thing?

Middlesbrough is the UK’s most affordable city

Scoring 6.51/10, it ranks lowest for house prices, rent, and overall living costs, making it the most budget-friendly place to live.

All three of the most affordable cities are in the North East

Middlesbrough, Sunderland, and Newcastle dominate the rankings, reinforcing the region’s reputation for lower living costs.

Newcastle is more expensive than Middlesbrough and Sunderland

Even though Newcastle is considered to be one of the top 10 biggest urban areas in the country, it still ranks in the top three for affordability, thanks to higher wages.

All three North East cities rank low in GDHI

Newcastle ranks 17th, Sunderland 26th, and Middlesbrough 27th out of the 34 areas in the study. In contrast, London’s GDHI (£34,036) is nearly double that of Middlesbrough’s.

Salaries in Middlesbrough and Sunderland are among the lowest

Middlesbrough (£36,649) and Sunderland (£36,404) have two of the lowest salaries in the study, ranking 28th and 29th respectively. Workers in these cities earn less than the UK average of £37,430.

A closer look at the most unaffordable cities in the UK

A closer look at the most unaffordable cities in the UK

|

Ranking |

City |

Average Yearly Salary |

Average Property Price |

Average Monthly Rent Price |

Average Annual Council Tax Bill |

Gross Disposable Household Income (GDHI) |

|

Most unaffordable |

London |

58,163 |

516,710 |

1,932.5 |

1,646 |

34,036 |

|

2nd most unaffordable |

Brighton |

46,059 |

420,181 |

1,739 |

1,753 |

26,461 |

|

3rd most unaffordable |

Bristol |

43,164 |

347,689 |

1,750.6 |

1,648 |

22,465 |

While affordability varies across the UK, London, Brighton, and Bristol stand out as the most expensive cities to live in. With sky-high property prices, rent, and general living costs, these locations may offer high wages, but the cost of living offsets any financial benefits.

Let’s break down what puts them at the top:

London tops the rankings for unaffordability

The capital has the highest property prices (£516,710) and rent per month (£1,933), contributing to it being the most expensive city in the study. Londoners' salaries are, on average, 24% higher than the national average, but it’s still not enough to balance out the cost of living.

Southern cities dominate the least affordable list

Six of the ten least affordable cities are in the South, which adds to the popular belief that there’s a significant cost gap between the North and South of England.

Manchester and Leeds are the only northern cities in the top 10

While traditionally seen as cheaper alternatives to London, we found that both cities have high housing and living expenses. Leeds has the 7th highest average property price, £283,822, and Manchester is 7th highest for private rent, £1,191 pcm.

High salaries don’t always mean better affordability

London (£58,163), Brighton (£46,059), and Bristol (£43,164) all have some of the highest average salaries in the study, but their high living costs outweigh the benefits of higher earnings. For example:

- London ranks 1st for salary but is still the most expensive city.

- Brighton has the 6th highest salary but ranks as the 2nd least affordable city.

- Bristol has the 7th highest salary yet ranks 3rd for the highest living costs.

Property and rent prices are driving unaffordability

London (£516,710), Brighton (£420,181), and Bristol (£347,689) rank 1st, 2nd, and 3rd for the highest property prices, mirroring their rankings as the most expensive cities. Rent also follows the same pattern. However, council tax rankings paint a different picture — London only ranked 7th. In contrast, Brighton ranked 4th and Bristol 6th, suggesting other costs contribute more significantly to unaffordability, like energy bills, transport, and groceries.

Edinburgh and Glasgow highlight a clear affordability divide in Scotland

Interestingly, Edinburgh ranks as the 8th most unaffordable city, while Glasgow ranks as the 8th most affordable. The Scottish capital’s higher property prices, with an average of £322,633, contribute to its lower affordability ranking and show the wide contrast between the two locations. In comparison, Glasgow’s average property price sits at £179,433.

Where does your area rank for affordability?

Where does your area rank for affordability?

Affordability isn’t just about where you live — it’s about how much you earn, what you spend, and what’s left over at the end of the month.

To help you understand where your city ranks, we’ve built an interactive map that lets you explore how your area compares to other places in the UK.

Essential expenses

Essential expenses

|

Average Annual Electricity Bill (regional) |

Average Property Price |

Average Rent Cost (pcm) |

Average Annual Council Tax Bill |

Gross Disposable Household Income (GDHI) |

|

|

Cheapest |

Yorkshire |

Aberdeen |

Middlesborough |

Sunderland |

Leicester |

|

Most Expensive |

East of England |

London |

London |

Swansea |

London |

How far your salary goes depends on more than just your paycheck — it’s shaped by housing costs, energy bills, and the price of your everyday essentials. In some cities, high wages are balanced by steep expenses; in others, lower incomes go further thanks to more affordable living costs.

With our research, we found that:

London dominates the list for high property prices

With an average house price of £516,710, it’s no surprise that London tops the charts. The capital’s property prices are 23% higher than Brighton (£420,181) and 49% higher than Bristol (£347,689), the next most expensive cities for buying a house.

Aberdeen has the UK’s cheapest property prices

At £134,368, it beats Middlesbrough (£139,855) and Sunderland (£141,716) as the most affordable place to buy a home. The top 10 of affordable properties was dominated by northern regions like Scotland, Northern Ireland, and the North of England – which reinforces the idea of northern areas being less costly than their southern counterparts.

Rent prices highlight a huge North-South divide

The cheapest rents are found in Middlesbrough (£609.60 pcm), Sunderland (£623), and Bradford (£676.70). Meanwhile, London (£1,932), Bristol (£1,750.60), and Brighton (£1,739) are the most expensive — over triple the price of the cheapest cities. It’s also worth pointing out that Manchester is the only northern city to make it into the top 10 priciest rental markets. The city’s rapid growth is fueled by an ambitious £10 billion ten-year regeneration plan to accelerate the economy, which brings it more in line with major southern cosmopolitan areas.

Electricity costs are highest in the East of England

Households here pay an average of £1,144 per year, compared to £1,127 in Yorkshire — the cheapest region for electricity.

Warrington stands out for high salaries

Warrington ranked 5th highest for average salary in the UK. According to Cities Outlook’s 2025 annual health check, this could be thanks to its growing business sector, especially the number of new companies driving tech innovation and economic growth. Warrington also ranks 8th in the UK for businesses per 10,000 people, showing its role as a growing economic hub.

High salaries don’t always mean affordability

Leeds ranks 9th for salary, possibly because of its reputation as a thriving media and technology hub. Using real-time industrial classifications (RTICs), which measure the latest industry insights in sectors like FinTech, CleanTech, and other emerging verticals, Leeds tech RTICs grew 125% faster than the national average. Despite this, the city still ranks 7th on the list of most unaffordable cities, suggesting that high wages don’t necessarily translate to affordability if housing and living costs are high.

Gross disposable household income varies massively across the UK

London households have more than double the GDHI of Leicester (£34,036 vs. £15,075), making it the biggest gap in the study.

Non-essential expenses

Non-essential expenses

|

The cost of a pint |

The cost of a meal for 2 |

The cost of a coffee |

The cost of a gym membership |

|

|

Cheapest |

Derby |

Luton |

Leicester |

Warrington |

|

Most Expensive |

London |

London |

London |

London |

While essential costs like housing and bills take up most of a household’s budget, non-essential spending — such as eating out, gym memberships, and coffee — also affect affordability. In some cities, these everyday treats are relatively affordable, while the costs quickly add up in others.

London is the most expensive city for non-essential spending

From a simple cup of coffee to a three-course meal, London tops the rankings for the highest non-essential costs. A meal for two at a mid-range restaurant costs £80 on average, while a cappuccino sets you back £3.72 — both the highest in the UK.

The cheapest places to grab a pint are in the Midlands and North

While London, Portsmouth, Brighton, and Belfast all have some of the most expensive pints in the UK (£6), the cheapest beer can be found in Derby (£3.60), followed by Aberdeen, Leicester, Southend-on-Sea, and Luton (£4 each).

Eating out costs vary massively across the UK

Norwich, Wolverhampton, Leicester, Nottingham, and Swansea serve the cheapest three-course meals for two, costing around £50 on average. After London, Belfast, Edinburgh, and Manchester offer the most expensive meals (£70 on average), showing that higher living costs in these cities extend beyond housing.

Coffee costs highlight affordability gaps

Leicester has the cheapest cappuccino in the UK (£2.69), followed by Bournemouth (£3.08) and Derby (£3.10). After London, Edinburgh is the most expensive place for a coffee (£3.71), reinforcing its ranking as one of the least affordable cities.

Gym memberships are significantly cheaper in some cities

A standard PureGym membership in Warrington costs just £15.99 per month, while in London, the average membership fee is £27.14 — almost double the price.

Transport costs

Transport costs

|

The cost of petrol |

The cost of car insurance |

The cost of a monthly bus pass |

|

|

Cheapest |

Belfast |

Bristol, Plymouth & Bournemouth (SW) |

Belfast, Lisburn & Derry |

|

Most Expensive |

Southampton |

London |

Bristol |

Transport plays a significant role in day-to-day expenses, especially for those who rely on public transport or drive regularly. While some areas benefit from cheaper petrol and public transport fares, others see commuters paying significantly more just to get around.

Here’s what the data says:

Petrol prices are highest in the South

Based on the average cost of a full tank of unleaded petrol, Southampton is the most expensive city for fuel in the UK at 141.3p per litre, followed by Bournemouth (140.8p) and Bristol (140.6p). Northern Ireland and Scotland have the cheapest petrol, with Belfast (132p) being the most affordable, followed by Lisburn (132.1p) and Aberdeen (137.1p).

Car insurance varies widely across regions

Londoners pay the highest car insurance premiums in the UK, with the West Midlands ranking second for expensive policies. The South West is the cheapest region for car insurance, making it a more affordable place to own and run a vehicle.

Bus travel costs double in some cities compared to others

Bristol has the UK’s most expensive monthly bus pass (£106 per month) — over twice the cost of Belfast, Derry, and Lisburn, which offer the least expensive passes. After the cities in Northern Ireland, Swansea (£53) and Cardiff (£58) have some of the cheapest public transport costs.

Differences between local authorities

Differences between local authorities

|

Average Annual Salary |

Average Property Price |

Average Monthly Rent Price |

Average Annual Council Tax |

Average Monthly Fee for Private Preschool |

Gross Disposable Household Income (GDHI) |

|

|

Edinburgh |

47,892 |

322633 |

1349.2 |

1,500 |

1,410.00 |

26565 |

|

Glasgow |

41,240 |

179433 |

1190.9 |

1,241 |

853.33 |

18571 |

While our study reveals a clear North-South divide in UK affordability, some local anomalies stand out — most notably, the contrast between Scotland's two largest cities: Edinburgh and Glasgow.

Historically, Edinburgh’s status as capital may give it the perception that it’s more costly than Glasgow, and our data highlights just how true this is — and how big the gap has become.

Here are some of the most notable differences:

- Property prices — Edinburgh’s average property price (£322,633) is nearly double Glasgow’s (£179,433). Rent follows the same trend, with Edinburgh’s average monthly cost (£1,349.20) outpacing Glasgow’s (£1,190.90) by 13%.

- Average salary — The average annual salary in Edinburgh (£47,892) is 16% higher than in Glasgow (£41,240), supporting its status as a financial and business hub. However, this wage difference doesn’t necessarily equate to better affordability — the cost of living in Edinburgh is nearly 9% higher than in Glasgow when we factor in essential expenses like accommodation, food, public transport and other living expenses.

- Gross disposable household income —Edinburgh’s annual GDHI (£26,565) is also only slightly ahead of Glasgow’s (£18,571), which is a much smaller gap than might be expected. This could be partly because of Edinburgh’s status as an arts and culture hub, with the popular Fringe Festival selling over 2.6 million tickets in 2024. This increase in visitor numbers will naturally have a knock-on effect by driving up the cost of dining, hospitality, short-term rentals, and even property values, which can impact local spending.

Key takeaways for small businesses

Key takeaways for small businesses

Jodie Wilkinson, Head of Partnerships at takepayments, said:

“The UK’s affordability landscape is shifting, and our study highlights some key trends that could have long-term implications for both businesses and consumers. While London remains the least affordable city, what’s striking is how other cities — particularly in the North — are catching up when it comes to high living costs. The idea that northern cities are universally ‘cheap’ is being challenged, with places like Manchester and Leeds now ranking among the least affordable in the UK.

Here are some of the key takeaways from our study to consider:

1. More UK cities are becoming expensive, not just London

For years, London has been in a league of its own for unaffordability, but other cities are catching up. Brighton and Bristol now rank as the second and third least affordable cities, showing that high living costs are no longer exclusive to the capital.

A key factor in this shift is the economic growth of major regional cities. As industries move away from London, cities like Manchester and Leeds have seen rapid development, pushing up property and rental prices.

With continued investment in business hubs outside of London, we may see even more locations become less affordable over time.

At the same time, financial pressures are mounting across the UK. We found that 97% of Brits are worried about saving money, highlighting that affordability concerns aren’t just tied to location — people across the UK are feeling the pinch.

Simple research of your local area’s disposable income and competitor pricing can help you make sure you’re offering the right balance of affordability and value. Also, regularly reviewing your prices can help you to stay competitive and align with your customers' financial realities.

2. The North East is affordable but may lack job opportunities

While affordability is high in Middlesbrough, Sunderland, and Newcastle, these cities also rank among the lowest for disposable income and wages. The lower cost of living in these areas is largely driven by cheap housing and rent, but with fewer high-paying jobs available, residents may have less disposable income to spend with local businesses.

According to ONS’ regional labour market data from the last quarter of 2024, the North East has an employment rate of 70.3%, which is below the national average of 75.0%. In comparison, the South East and South West — where affordability is lower — have the highest employment rates in the UK at 78.8% and 78.7%, respectively.

Looking ahead, job creation is expected to favour London and Southern England. Between now and 2027, employment in the UK is set to grow by 1.1% annually, but London (1.5%), the South East (1.3%), the South West (1.2%), and the East of England (1.2%) are the only regions expected to exceed this. All other areas are estimated to increase slower than the UK’s average, including the North East which has a predicted employment growth rate of 0.9%.

For jobseekers and businesses alike, this highlights the trade-off between cost of living and access to employment.

3. Rising business costs and closures could reshape local economies

In 2024, 44% of UK businesses faced potential closures, with other research estimating that the country lost 37 shops each day.

The West Midlands saw the highest number of net business closures in 2023, with 4,920 more businesses shutting down than opening, followed by the North West, with a net loss of 3,845 businesses. Meanwhile, retail was the worst-affected sector, with a net loss of 4,695 shops, suggesting further challenges for high-street businesses.”

Methodology

Methodology

To provide a comprehensive look at affordability across the UK, takepayments conducted an in-depth analysis of 34 major cities and towns from across the 12 UK regions. We focused on the three largest population centres in each region to ensure a fair geographical spread.

Data collection

The affordability index was calculated using 16 key financial factors, covering essential and non-essential costs. Data was sourced from a range of government, industry, and cost-of-living databases.

The following affordability factors were included in the study:

- Cost of a pint – Data sourced from Numbeo, recording the average cost of a 500ml domestic draft beer in each city.

- Number of budget supermarkets – Sourced from the Office for National Statistics (ONS) dataset on chain supermarkets.

- Average annual energy bills – Sourced from the UK government’s energy statistics, with regional figures used where city-specific data was unavailable.

- Public transport costs – The monthly cost of a bus pass was recorded for each city, using prices from the city’s main transport provider.

- Average house price – The average cost across all property types was collected from the ONS UK house price index.

- Average salary – Data was sourced from the ONS Annual Survey of Hours and Earnings (ASHE), using the gross annual pay for full-time employees per city.

- Average rent price – The monthly private rental cost across all property types was collected from ONS housing data.

- Average council tax – Data was collected from government sources for England, Scotland, and Wales.

- Gross disposable household income – Sourced from ONS Gross Disposable Household Income (GDHI) data.

- Childcare costs – Data collected from Numbeo, recording the monthly cost of private preschool or kindergarten per child.

- Petrol costs – The average price of a full tank of unleaded petrol was recorded for each city using UK fuel price tracking website WhatPrice.

- Home insurance – Regional annual home insurance premiums were collected from a MoneySupermarket study.

- Car insurance – Data sourced from Confused.com.

- Non-essential costs – The study also examined discretionary spending, including:

Each city was assigned a score from 1 to 10 for each affordability factor, based on a ranking system where lower costs received higher scores. The final affordability index for each city was calculated by averaging all factor scores, with higher overall scores indicating greater affordability.

Data caveats

Northern Ireland council tax – NI uses a ‘rates’ system rather than council tax, making it incomparable to UK council tax figures. NI cities were still included in the overall ranking but without this metric affecting their scores.

Missing data adjustments – Some datasets did not have complete information for all cities. In these cases, adjustments were made to ensure missing data did not negatively impact the overall affordability ranking.

Variations in transport and childcare costs – In some cities, transport and childcare pricing varies widely by provider, so the most widely used or lowest-cost option was chosen for consistency.

Discover more insights from takepayments

Discover more insights from takepayments

For more original studies and findings around consumer spending habits, explore more of our latest reports: