Britain's spending habits in 2024: are we saving or splurging?

New data reveals that 1 in 5 Brits have no savings.

- 2 in 5 Brits have to dip into their savings every few months

- Over one-third of Brits (38%) don’t know what their current bank account balance is

- Almost 1 in 5 Brits have no savings at all

- 97% of Brits are worried about saving money right now

- One-third of Brits (33%) have hidden an irresponsible purchase from a partner

- 16% of people said they don’t save any money monthly

UK consumers are still reeling from financial uncertainty, which has made managing money trickier than ever. But despite a cost-of-living crisis and soaring inflation rates, consumer spending has increased, and hope for economic recovery is on the horizon.

But this begs the question: how are Brits really handling their finances?

To get a clearer picture, we surveyed 1,000 members of the British public and asked them ten questions about how much they’re spending and saving and what their priorities are. We categorised the results by key demographics like age, gender, and location in the UK.

Our goal was simple: to provide a clear picture of how consumers manage their money — and to see if common assumptions around financial responsibility still hold true. From gender stereotypes to the financial competency of different age groups, here’s what we found.

How do Brits spend their payslip?

How do Brits spend their payslip?

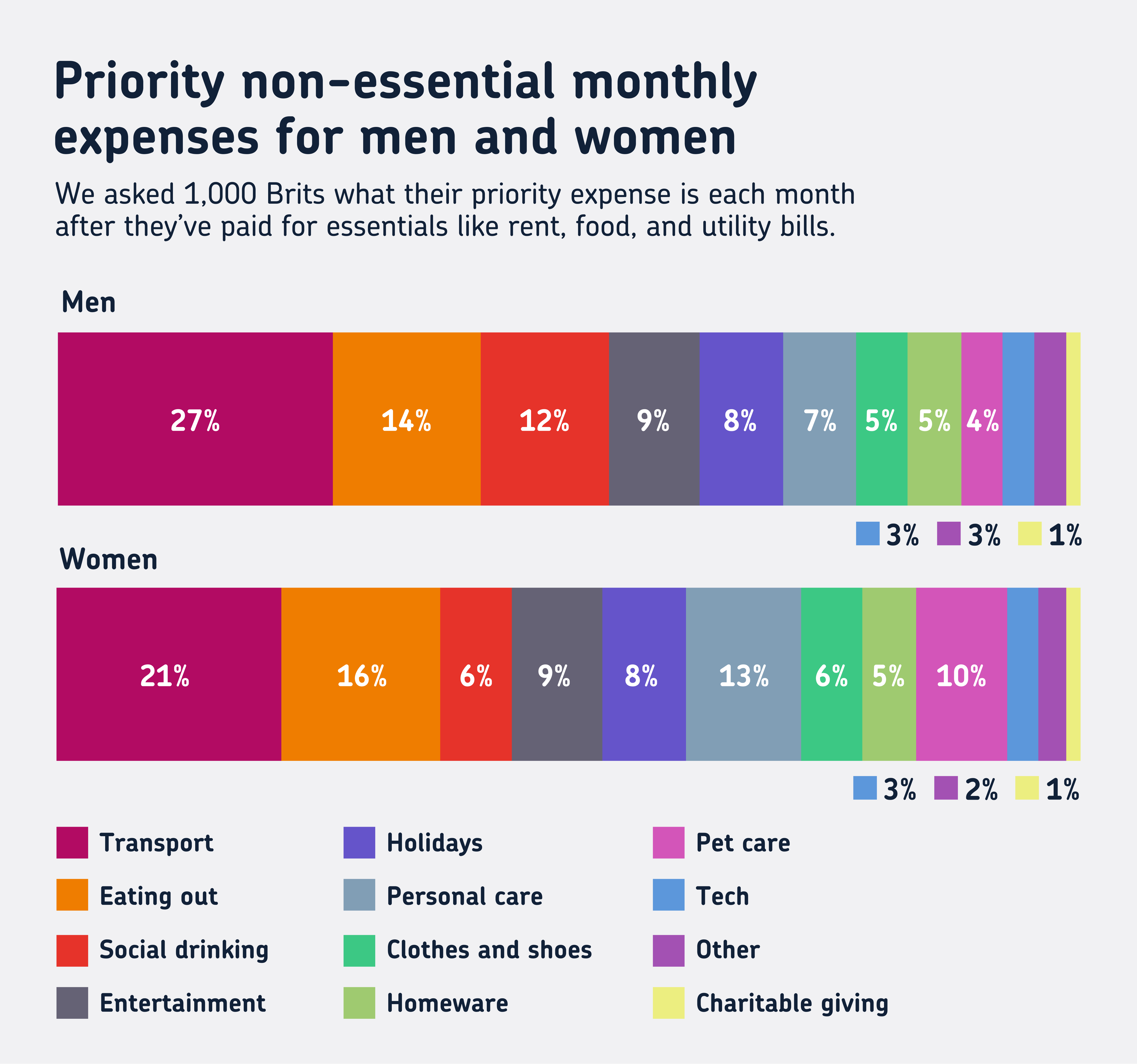

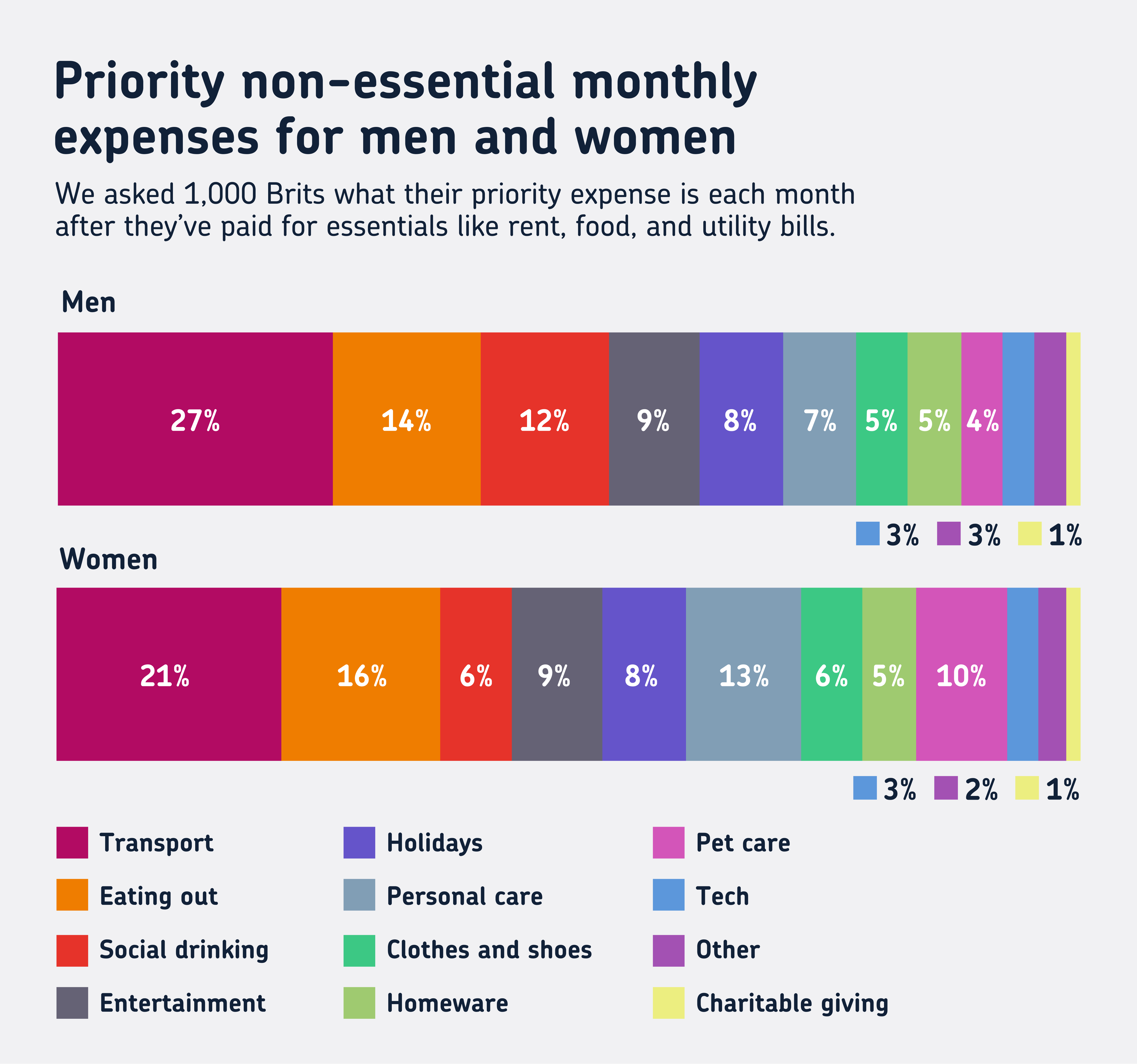

It feels pretty obvious that the majority of our payslips go towards essential living costs like mortgages or renting, food, and bills. But aside from non-negotiables, our survey revealed that transport is the biggest expense for Brits.

Nearly a quarter (24%) of respondents said that transport, including commuting and fuel costs, is where most of their money goes after covering the essentials. The second most common expense is eating out (16%).

When comparing the results by gender, we spotted some interesting differences. Transport was the most costly expense for both men (27%) and women (21%), but after that, 12% of men spent money on social drinking, while personal care was next on the priority list for women (13%).

There was also little difference in clothing purchases for females (6%) and males (5%).

What are consumers prioritising when spending their wages?

What are consumers prioritising when spending their wages?

Brits' top five spending priorities are:

- Paying solely for essential expenses

- Saving for future investment (e.g, property)

- Saving up for holidays or trips away

- Paying off loans or debt

- Saving for retirement

Nearly half of Brits (47%) said their main focus is solely paying for essential expenses. Given the economic struggles over the past few years, it’s unsurprising that so many are prioritising covering day-to-day necessities over saving for future goals.

An overwhelming 97% of respondents said that they’re concerned about saving – with only 3% saying that they aren’t worried and would rather spend their wages on having fun – highlighting the financial pressures that the majority of people in the UK are facing.

If we consider the responses by gender, 10% of men stated that saving for retirement is a key focus, with the figure halving for women (5%). 18% of men also highlighted that saving for future investments like property was their next priority, with 16% of women agreeing.

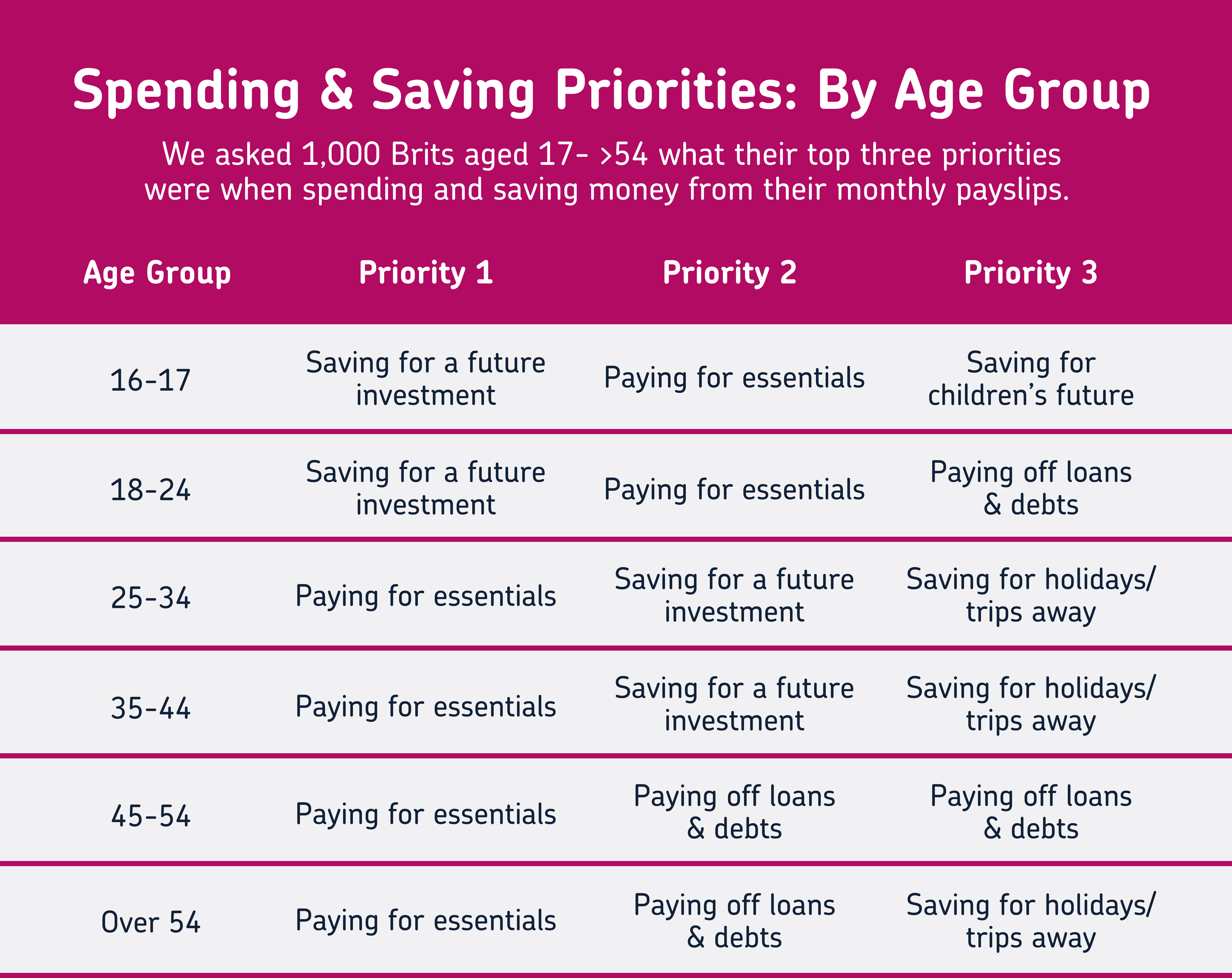

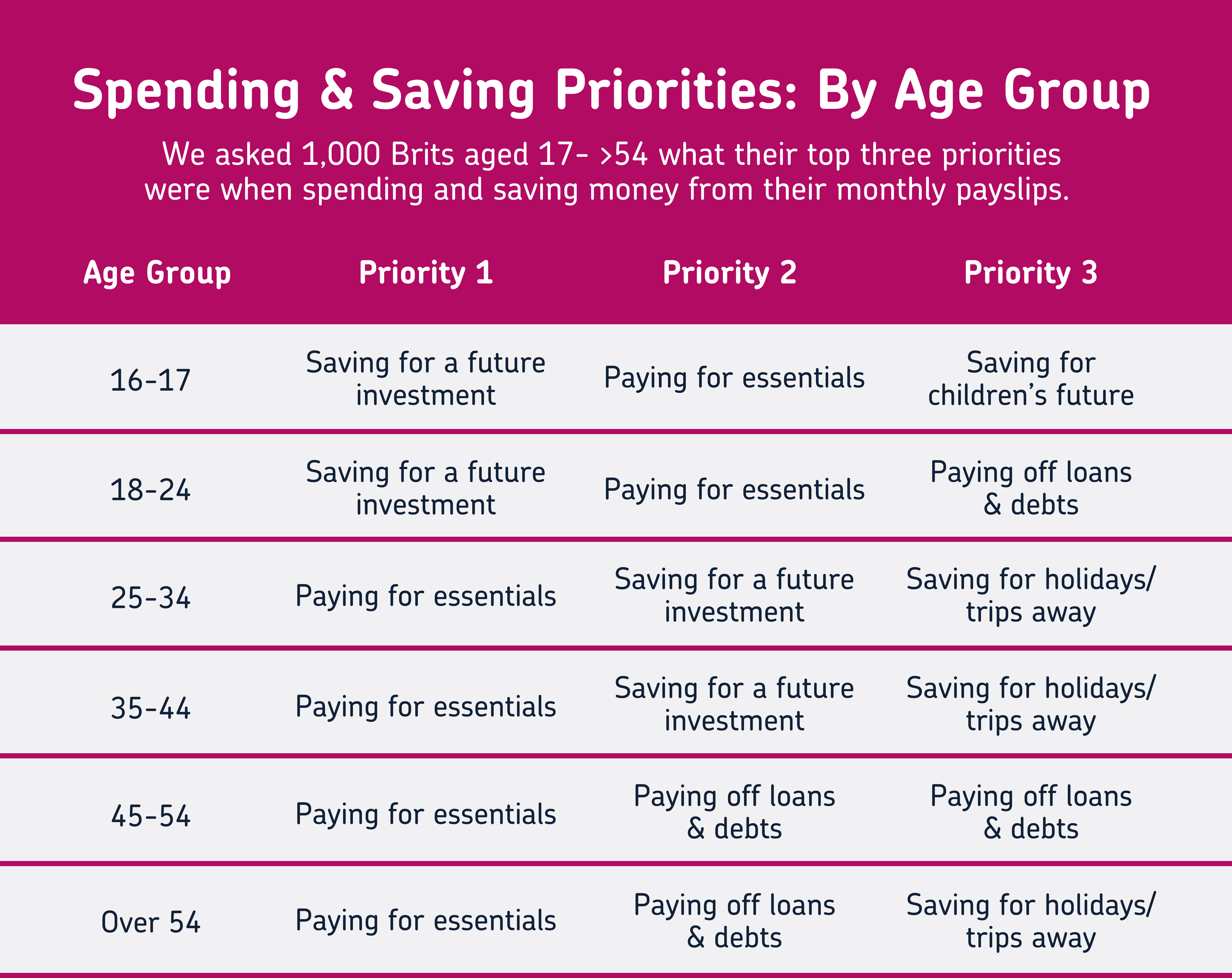

The data also gave us some key insights into financial priorities across different age groups. Unsurprisingly, saving for future investment was the clear winner for people aged 16-17 and 18-24, while those aged 25 and over are focusing on paying for the essentials.

Most interestingly, saving for their children’s future came in as a third priority for 16-17 year olds, indicating early concerns around family responsibilities. Loan or debt repayment was next after essential payments for 45-54 year olds. With the age of first-time homeownership getting later and the average at 33 years old as of 2024, it’s likely that many in this group are dealing with mortgage repayments or other significant loans.

Is it true that men are better savers than women?

Is it true that men are better savers than women?

Financial literacy is a fancy way of talking about how well we use money, manage it, budget, and invest.

There's a common belief, often referred to as the ‘financial literacy gender gap’, that men are generally more financially competent, while women may be less informed when it comes to managing their finances.

Campaigns like Starling Bank’s #MakeMoneyEqual have highlighted this gap and its portrayal in society, and it’s something we wanted to explore too.

Next, we’ll explore these stereotypes by reviewing our data on people’s saving and spending habits. From how much people are able to save each month to the reasons behind those savings, our aim is to find out if men and women approach money management differently.

How much do men and women save monthly?

How much do men and women save monthly?

Our survey revealed that Brits save a wide range of amounts each month, with the most common savings bracket being £201-500, chosen by 24% of participants. However, not everyone is managing to save — 16% of Brits reported they don’t save anything at all, reflecting the ongoing financial pressures many are facing.

When we break down the data by gender, it becomes clear that men manage to put away more each month than women.

- Men – Almost 1 in 4 (24%) men save between £201-500 each month, which was the most common amount for this group. Meanwhile, 14% of men said they don’t save anything from their monthly paycheck, and 10% said they only manage to save £1-50 per month.

- Women – For women, the picture is slightly different. The most common answer was “I don’t save anything at all,” with 18% admitting they are unable to save each month. For those who do save, the second most common amount was £101-200, with 17.5% choosing this option.

Now, it might be tempting to think that men are just better savers, but it’s important to dig a little deeper at other factors that could be having an impact. The gender pay gap, for example, is still very much a thing — in 2023/24, the average hourly pay gap between men and women is 11.8%. That’s a pretty big deal because it means men, on average, could be taking home nearly 12% more than women. And when you think about it, a 12% bump in salary can make a huge difference when it comes to how much people can save after covering their essentials.

In fact, research has found that women also face inequalities in job quality, which could result in less access to benefits received through employment. These include things like pensions, unemployment benefits, or maternity protection, which can have a knock-on effect that further impacts their financial vulnerability – and, therefore, their ability to save.

So, while financial know-how might play a role, we can’t ignore the bigger socioeconomic factors that could be at play here.

How much have men and women saved overall?

How much have men and women saved overall?

The data paints a similar picture when it comes to overall savings. A significant chunk of Brits — 19% — have no savings at all, making it the third most common response. For those with savings, the most common amount falls between £1,001-5,000, with 12% of respondents selecting this bracket. Interestingly, nearly 10% of Brits have managed to save over £50,000.

Breaking it down by gender, the results show that men generally have more saved up than women:

- Men – The most common amount saved by men is £1,001-5,000 (16%), but 7% of men admitted they don’t have any savings. Notably, 14% of men said they’d saved more than £50,000, suggesting a stronger position for long-term wealth building.

- Women – Among women, 13% said they have no money saved at all, compared to 7% of men. The most common amount saved was also £1,001-5,000 (16%), but only 5% of women reported having more than £50,000 saved up, a clear difference from their male counterparts.

These results highlight a potential gap in savings between men and women, with men seemingly in a better position to accumulate larger savings over time.

However, as with monthly savings, this gap may be influenced by broader socioeconomic factors like income disparities and access to benefits. For example, if we take into account the gender wealth gap and project it to retirement age, studies have estimated that it could widen to 42% by the time women reach the age of 64.

Plus, the Trades Union Congress noted that women in their early 60s typically have built up only a third of the pension wealth compared to men, impacted by part-time work and unpaid care responsibilities, which often affect women more than men.

Are men or women more financially responsible?

Are men or women more financially responsible?

When it comes to spending, the age-old question of who’s more financially responsible – men or women – always stirs up debate. Are men naturally better at budgeting, or do women hold the purse strings tighter?

Recent studies suggest that women may actually be more cautious with their spending, with 65% of women actively tracking their expenses compared to just 55% of men. But, other research implies that men tend to have higher savings and pension pots on average, possibly due to the persistent gender pay gap.

In this section, we’ll explore how Brits are spending their money and whether those common assumptions about gender and financial responsibility hold true.

Do Brits know how much money is in their bank account right now?

Do Brits know how much money is in their bank account right now?

As it turns out, most Brits have a pretty good handle on their finances. According to our survey, 62% said they definitely know their current bank balance, and 33% have a decent ballpark figure in mind. Only 5% admitted they had no clue how much money was sitting in their account.

When we break it down by gender, things are pretty similar:

- Men – Nearly two-thirds (65%) of men are confident they know their exact bank balance, with 32% having a general idea. Only 4% of men said they didn’t know their balance at all.

- Women – Likewise, 60% of women said they were certain about their bank balance, with 34% knowing the approximate figure, and just 5% admitted they had no idea.

This data hints that both men and women are equally on top of their finances, challenging the idea that one is more financially aware than the other.

In fact, YouGov research shows that 69% of Brits check their bank balances using mobile banking daily or at least once a week, showing that a large portion of people are taking their money management pretty seriously.

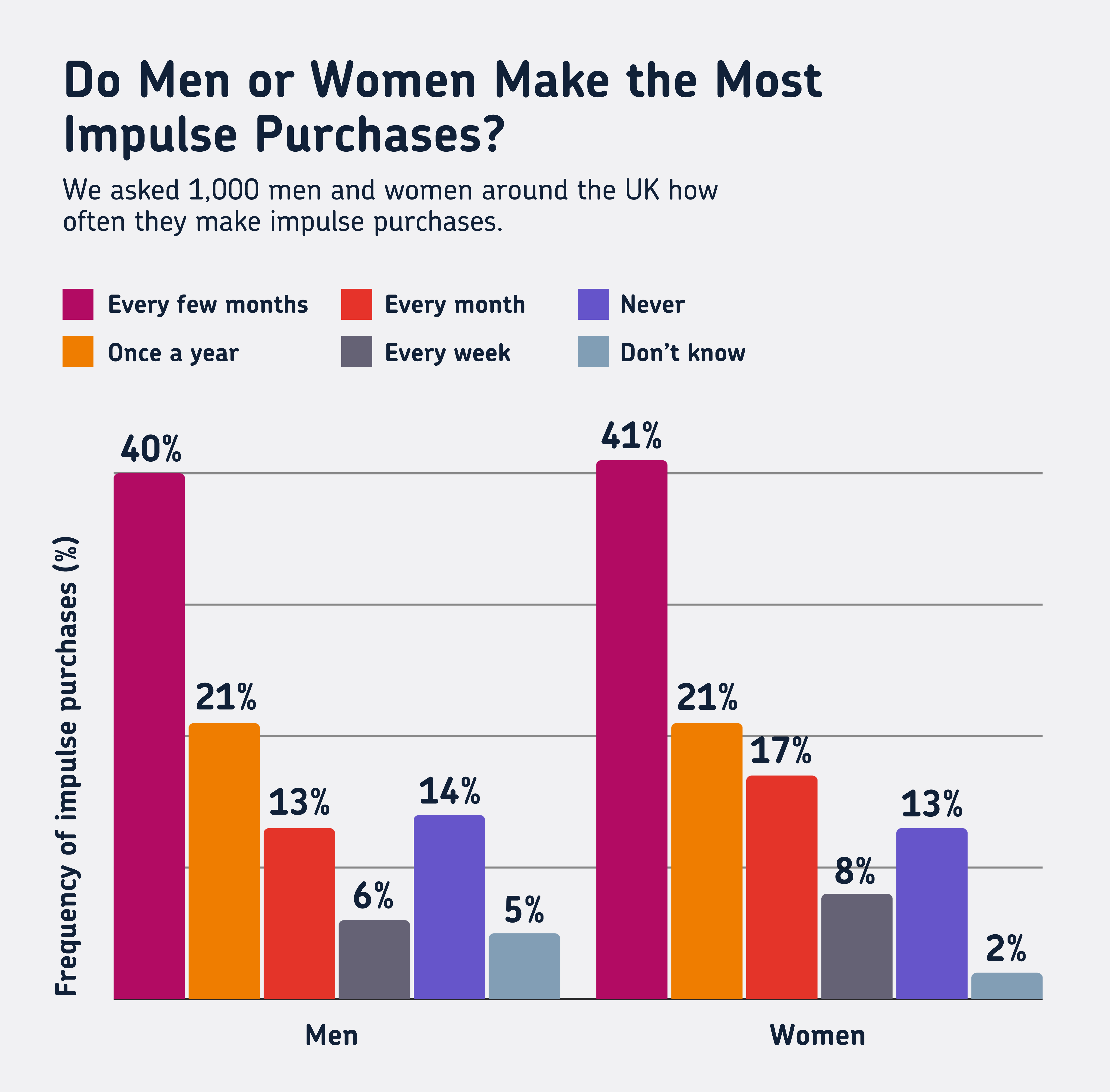

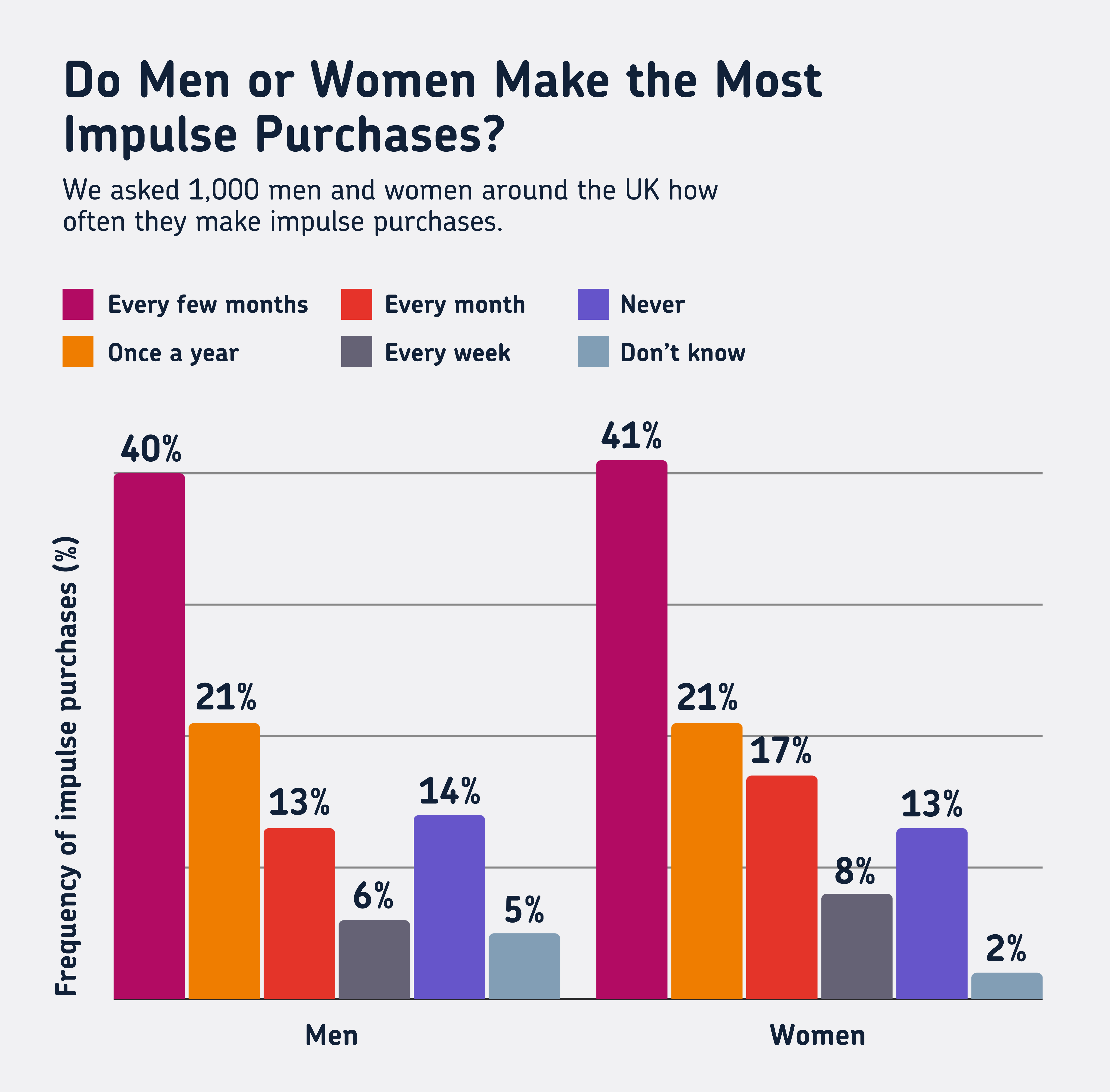

Do women make more impulse purchases than men?

Do women make more impulse purchases than men?

When it comes to impulse purchases, our survey shows that the majority of Brits indulge every few months, with 40% admitting to making impulsive buys every now and then. Only 13% said they never give in to temptation, while 15% admitted to a monthly splurge.

Surprisingly, there’s little difference between men and women, challenging the old stereotype of women being impulsive shoppers:

- Men – 40% make impulse buys every few months, 13% do so monthly, and 14% never make impulse purchases.

- Women – 40% also make purchases every few months, with 17% doing so monthly. Only 13% say they never impulse buy.

The nearly identical results suggest that impulsive spending isn’t more common based on gender, proving that both men and women are equally likely to splurge from time to time.

How often do men and women dip into their savings?

How often do men and women dip into their savings?

Dipping into savings is a regular habit for many people in the UK, with 39% saying they reach for their savings every few months. However, 19% admitted to having no savings at all, and another 19% said they never need to touch theirs.

When comparing genders, the results are similar, though women are more likely to say they have no savings:

- Men – 42% dip into their savings every few months, 19% dip monthly, and 15% have no savings.

- Women – 37% dip into savings every few months, 22% do so monthly, but 21% said they have no savings. Meanwhile, 18% said they never dip into their savings.

Do Brits hide their irresponsible purchases from their partners?

When it comes to financial transparency in relationships, most Brits are staying honest. Our survey found that 60% of people with partners have never hidden an irresponsible purchase, but 33% admitted they’ve done it at least once.

- Men – 59% of men with partners said they’ve never hidden a purchase, while 33% confessed that they have hidden an irresponsible purchase.

- Women – Similarly, 61% of women said they’ve never hidden a purchase from their partner, while 33% said they have.

The data highlights that financial secrecy, or financial infidelity if you want to get technical, can affect everyone equally. But there could be more to be said when we dig into why Brits resort to less-than-honest tactics.

A study into couples' biggest financial challenges highlighted that the cost of living crisis is the most sensitive financial topic for 37% of couples, leading to 28% of them arguing about finances more often. This strain could be a contributing factor to people hiding purchases from their other half.

Do Brits trust their partners with money?

Trust is the key foundation of any relationship, and when it comes to finances, the majority of Brits seem to have confidence in their partner’s money management. Our survey revealed that 85% of people trust their partner with money, while 12% admitted they don’t.

When we look at it by gender:

- Men – 86% of men with partners said they trust their partner with money, and 38% of them have joint bank accounts with their significant other. Only 12% reported not trusting their partner’s financial decisions.

- Women – Similarly, 84% of women said they trust their partner with money, with 30% saying they trust them but prefer to keep separate accounts. Meanwhile, 13% of women reported a lack of trust when it comes to their partner’s financial choices.

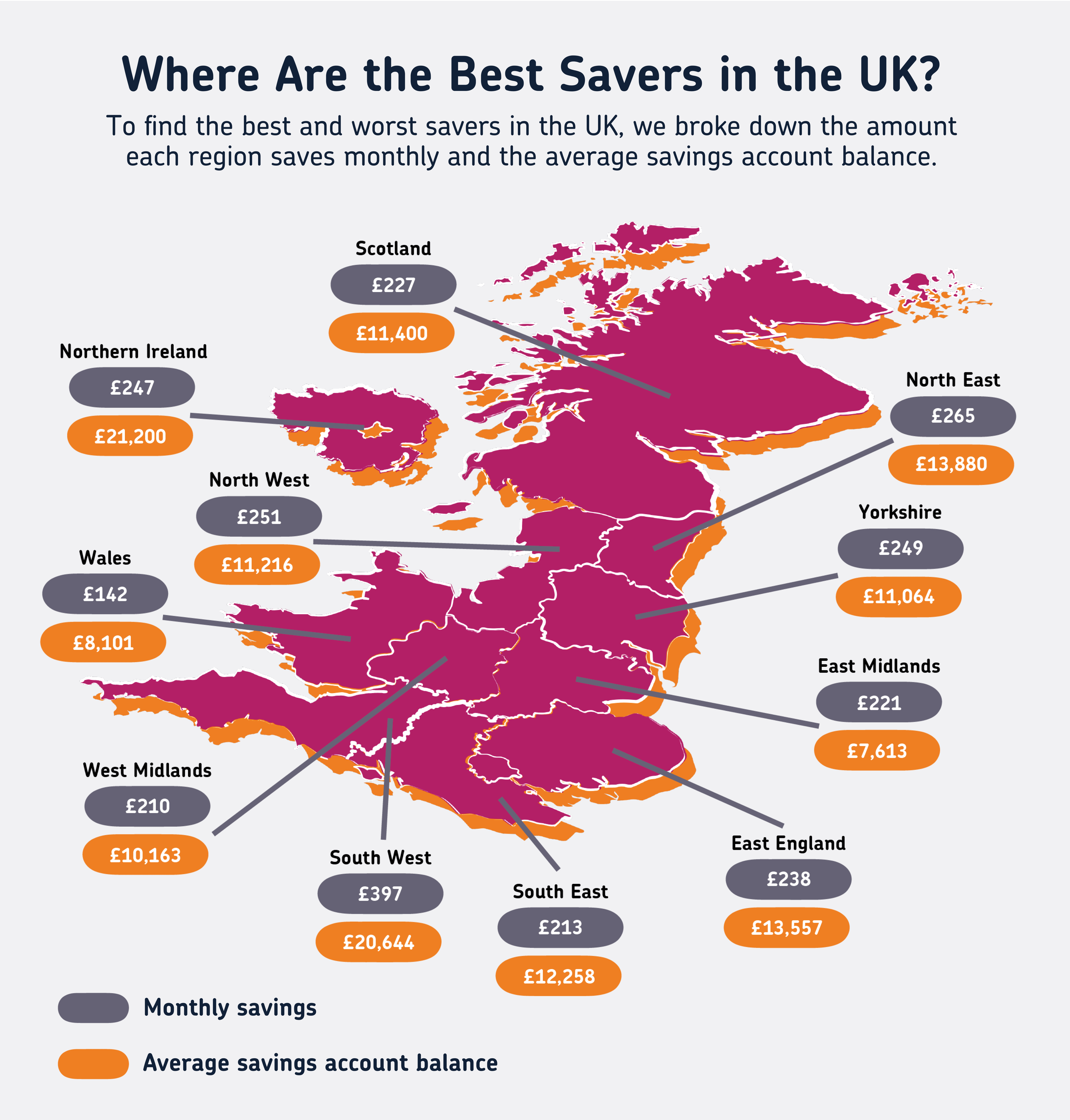

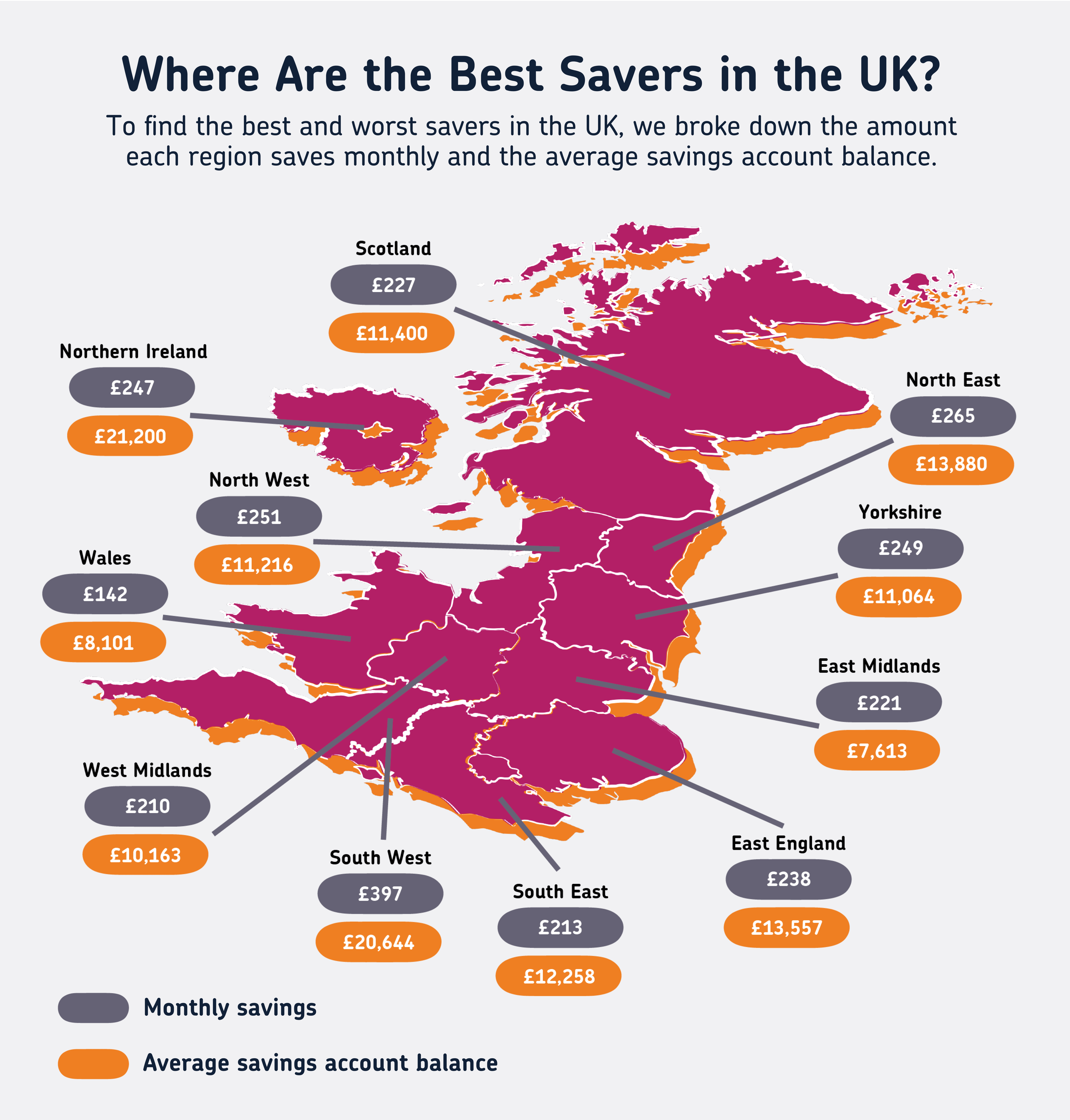

Where are Britain’s best savers?

Where are Britain’s best savers?

Northern Ireland is leading the savings race, with an impressive average of £21,200 in overall savings and £247 tucked away each month. Close behind, the South West also shows strong savings habits, with £20,644 in total savings and a higher monthly average of £397 saved.

At the other end of the spectrum, Wales and the East Midlands are perhaps feeling the pinch a little more, with averages of £8,101 and £7,613 in total savings, respectively, and more modest monthly savings contributions.

Do Brits think contactless payments make budgeting harder?

Do Brits think contactless payments make budgeting harder?

With the rise of contactless payments and mobile wallets, many Brits seem to find it trickier to manage their spending. Our survey found that 57% of respondents agree that contactless payments make them spend more and make budgeting harder.

On the flip side, 36% disagreed, showing that while this concerns the majority, a significant portion of people feel confident in their spending habits, even with digital payments.

When comparing men and women, the results were close, though women felt slightly more strongly about the impact of contactless payments:

- Men – 54% agreed that contactless makes them spend more and makes it harder to budget, with 41% disagreeing.

- Women – 59% of women felt the same way, while 32% disagreed.

Breaking it down by age, younger generations were much more likely to feel that digital payments make it harder to manage their money:

Young Brits clearly feel the strain of contactless spending more than older generations, which could tie into their higher use of digital payment methods, along with the fact that they’ve grown up with contactless payment technology, whereas older generations have had to adapt over the years.

Our study into consumers’ preferred payment method found that contactless was by far the most popular payment method in the UK, with convenience listed as one of the key reasons. Given their comfort with mobile wallets and tap-to-pay options, it makes sense that they might find it easier to spend freely — and harder to stick to a budget.

How to save money even when using contactless and mobile wallet payments

How to save money even when using contactless and mobile wallet payments

Jodie Wilkinson, Head of Partnerships at takepayments, shares her top tips for keeping your finances in check:

“With over half of UK consumers saying that contactless and mobile wallet payments make it harder to budget, it’s clear they can sometimes make us feel a little disconnected from the value of our money, and we can easily lose track of how much we’re spending.

For those worried about overspending with contactless and mobile wallets, consider:

- Track your spending with apps – Bank of England researchers have carried out a study which theorised that contactless payments can actually help with budgeting because each transaction is recorded on online banking apps, so shoppers face the music on exactly what they’re spending. Many of them let you set up instant notifications, which help you keep tabs on your purchases as they happen.

- Set a weekly budget – Only keeping limited funds in your current account means you’ll have a set amount to spend each week, and if you’re running low, it’s a clear sign to hold off on more purchases.

- Contactless can be more secure than cash – Finally, let’s not forget that mobile payments can often be more secure than cash. We’ve seen the rise of the cash stuffing trend – where budgeters place sums of money into envelopes to account for different expenses – but home insurance provider Admiral revealed that cash theft claims had risen by 77%, with reports of large sums of money in envelopes being stolen. With biometric features like fingerprint or facial recognition, it’s harder for someone to access your funds compared to physical cash.”

Learn how takepayments could help secure and transform your card payments for your customers.

Discover more industry-leading insights

Discover more industry-leading insights